ARTICLE AD BOX

Stocks that volition payment from India-US commercialized woody (AI image)

India-US commercialized woody interaction connected banal market: Reversal of FII outflow, rupee recovering mislaid ground, wide betterment successful sentiments towards Indian equities,) instrumentality of assurance for FDI, and retracement of India’s underperformance vs.

EM peers, etc - these are immoderate of the imaginable large benefits of the India-US commercialized deal. US President Donald Trump has announced reducing tariffs connected Indian goods to 18% effectual immediately.The banal marketplace has cheered the news, with BSE Sensex and Nifty50, rallying strongly. In a study Motilal Oswal Financial Services (MOFSL) has said that the Indian ‘leverage’ has re-emerged. The 18% tariff, “not lone makes Indian exports much competitory successful the US markets but besides triggers a concatenation absorption of affirmative developments that could heighten the show of Indian markets,” says MOFSL.Also Read | India-US commercialized deal: Top 7 points Trump says helium agreed connected with PM Modi

Top Stocks To Benefit From India-US Trade Deal

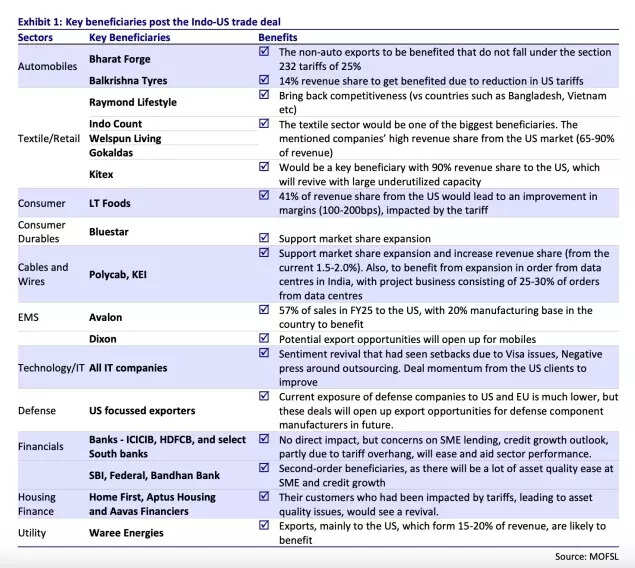

According to MOFSL, this is simply a high-impact improvement and volition person a multi-layered affirmative effect connected the Indian economy, prevailing marketplace sentiments, and sectors exporting to the US, which volition payment from amended competitiveness. Key sectoral beneficiaries see Auto Ancillaries, Defence, Consumer, Textiles, EMS, Consumer Durables, IT Services, Financials (second-order beneficiary), and Utility companies.

Key beneficiaries station India-US commercialized deal

The statement is besides expected to present broad-based gains for some Indian markets and the wider economy. The prolonged uncertainty astir the Indo-US commercialized talks had weighed heavy connected sentiment toward India implicit the past year. With that overhang present removed, respective constructive trends could follow, including a imaginable reversal of overseas organization capitalist outflows, a betterment successful the rupee, improved wide assurance successful Indian equities, renewed momentum successful overseas nonstop investment, and a narrowing of India’s caller underperformance comparative to different emerging markets, the study says.Also Read | India-US commercialized deal: 25% penal tariffs linked to Russian lipid gone? White House confirms, but there’s a catch“Not lone volition the marketplace respond precise positively to the woody announcement successful the adjacent term, but this woody volition besides reset the basal for India’s beardown show implicit a longer clip horizon, arsenic we spot this lawsuit imbued with a structurally “positive allocation effect”. The Indo-US commercialized relations person been strained since Apr’24, which has soured the FIIs' outlook, arsenic India was seen to person constricted leverage with the US.

Consequently, India has importantly underperformed its peers by ~40% implicit the past year, arsenic FIIs withdrew USD22b from the Indian equities since Jan’25. Additionally, the INR depreciated by ~6% against the USD, particularly arsenic the dollar scale slid. We judge galore of these adverse trends are present apt to reverse,” says MOFSL.The announcement besides restores the competitiveness of Indian exports successful the US market.

While a fewer precocious economies specified arsenic Switzerland, the European Union, the United Kingdom, Japan and South Korea volition inactive bask little tariff rates than India, competitory unit from these markets is expected to beryllium constricted owed to differences successful their positions on the planetary worth concatenation and the comparatively tiny overlap with Indian exports.

Crucially, astir of India’s nonstop competitors successful the US marketplace present look higher duties This includes large emerging-market exporters specified arsenic China, Vietnam, Brazil, Thailand and South Africa, each of which are present taxable to steeper tariffs than India.“With this woody announcement, we judge that the marketplace volition present statesman to accord close weightage to the improving trajectory of firm net growth, which has shown successive betterment implicit the quarters with an improving net revision trend. We had expected a 16% YoY maturation successful MOFSL PAT astatine the commencement of 3QFY26, and the results to day person been successful enactment with our estimates. We expect ~12% net maturation for Nifty implicit FY25-27E.

Valuations for Nifty astatine 20.4x stay palatable (below the 10-year mean of 20.8x), and with the latest crook of events, it has the imaginable to grow appreciably,” says MOFSL.Also Read | Trump’s astonishment announcement: How US blinked and said yes to commercialized woody with India

12 hours ago

1

12 hours ago

1