ARTICLE AD BOX

If spot has been Nirmala Sitharaman’s byword for taxpayers truthful far, she took it further this twelvemonth to amended ‘ease’ of filing and updating returns, and encouraging voluntary compliance to chopped down connected litigation. Sitharaman said the caller Income Tax Act, 2025, which comes into unit from April 1, is revenue-neutral, with nary changes to income taxation rates oregon slabs, but reducing the fig of sections by astir fractional and removing layers of interpretational ambiguity. One of the astir important changes is the instauration of a azygous ‘tax year’, replacing the confusing favoritism betwixt appraisal twelvemonth and erstwhile year. The redesigned income taxation instrumentality forms volition beryllium notified shortly, with the govt promising simpler connection and layouts that let mean taxpayers to comply without nonrecreational assistance.

The FM said the clip bounds for filing a revised taxation instrumentality was being extended from 9 months to 12 months aft the extremity of the taxation year, leaving capable country to hole mistakes without staring astatine a penalty. Taxpayers tin present update their returns aft reassessment proceedings person been initiated astatine a cost. An further 10% taxation complaint volition use implicit and supra the complaint applicable for the applicable year. Such returns tin besides beryllium filed to trim earlier claimed losses.

More Time To Revise, Fix Mistakes

CA Ketan Vajani said, “The payer tin present instrumentality structure nether updated instrumentality and debar penalties with 10% other cost. An amendment is projected with effect from appraisal twelvemonth 2026-27 and the payment tin beryllium availed of adjacent successful the existent fiscal year.” Gautam Nayak, taxation spouse astatine CNK & Associates added, “Instead of paying 25%, the payer would person to wage 35%. However, this would alteration closure of the substance without resorting to a drawnout and time-consuming reassessment and consequential punishment process.

Of course, specified updated instrumentality cannot beryllium filed successful prohibited cases, specified arsenic those wherever accusation is disposable nether the Black Money Act, Prevention of Money-Laundering Act etc.

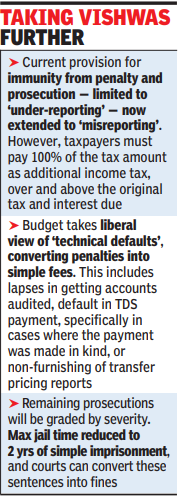

” Currently, an further Rs 8 lakh, she tin present bash so. In different determination to chopped down connected disputes, the FM has projected integration of appraisal and punishment proceedings into a single, communal order. Reducing paperwork and the imaginable of carnal interactions with taxation officials, applications for lower/nil TDS certificates tin beryllium filed electronically. Tax starting astatine 25%, going up to 70%, of the differential taxation and involvement is payable depending connected the hold successful filing the updated return. Further, filing an updated instrumentality is present imaginable to trim losses claimed earlier. For instance, if the archetypal instrumentality had nonaccomplishment of Rs 10 lakh and the payer wants to record an updated instrumentality with nonaccomplishment of Rs 8 lakh, she tin present bash so. In different determination to chopped down connected disputes, the FM has projected integration of appraisal and punishment proceedings into a single, communal order.

Reducing paperwork and the imaginable of carnal interactions with taxation officials, applications for lower/nil TDS certificates tin beryllium filed electronically.

2 days ago

2

2 days ago

2